RURAL AND AGRICULTURAL FINANCE IN A DIGITAL ERA

Module 1: Trends in digitizing rural finance

Module 1: Trends in digitizing rural finance

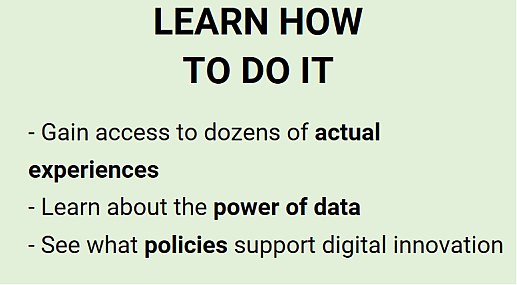

Look at global trends in digital rural finance and the various successful business models led by MNOs, banks and e-commerce.

Emilio Hernandez, CGAP

Module 2: Customer centricity

Module 2: Customer centricity

Explore techniques for improving the customer experience along the client journey when designing financial services for farming families.

Gerhard Coetzee, CGAP

Module 3: Market segmentation

Module 3: Market segmentation

Examine market segmentation, with special emphasis on developing ‘personas’ and on women in rural and agricultural livelihoods (WIRAL).

Jamie Anderson, CGAP

Module 4: Financing the smallest farming families

Examine approaches microlenders can adopt to manage risk in rural finance, with a special emphasis on female headed farming households.

Linda Jones, Consultant

Module 5: Innovations in digitalizing agricultural value chains

See recent innovations in the digitalization of value chain finance, including new business models and partnerships with agritech firms.

Massimo Pera, FAO

Module 6: Innovations in digitalizing smallholder finance

Explore recent innovations in the digitalization of supply chains; how these reduce costs and result in new business models.

Albert Boogaard, Rabo Partnerships

Module 7: Agricultural insurance

Review opportunities to provide insurance at scale for protecting smallholders from production risk and weather-related perils, with a special emphasis on digitalization.

Andrea Stoppa, Consultant

Module 8: AgriTech and E-Commerce Platforms

Explore e-commerce firms and agritechs that build rural service ecosystems: e-commerce, payment & financial transactions, agroclimatic data, agronomic advisory, insurance, and supplier companies.

Panos Varangis, IFC

Module 9: Green finance

Feature a panel that will speak to different dimensions of the challenge of ‘Green Finance’ in the small and microfinance arena.

Juan Buchenau, Consultant

Module 10: Public policies

Examine policies that enable digital rural finance, including G2P programs, agricultural subsidy policies, public-private collaboration for financial innovation.

Toshiaki Ono, Ajai Nair, World Bank