MFT IN ENGLISH: Focus on the Future

Adapting our model and methods to generational changes in our staff and clients

July 21-25, 2025 – ITC-ILO – Turin, Italy

MFT IN ENGLISH GRID

MASTER CLASS:

Managing Growth, Competition and Inclusion

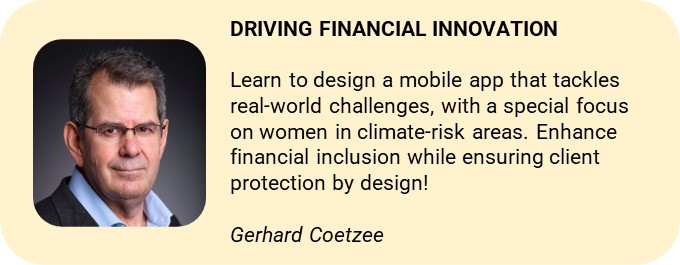

Each morning starts with a masterclass on hot topics such as climate change resilience, gender-specific opportunities, open banking, over-indebtedness in competitive markets, and rural financial services.

Create growth hacking in order to create actionable insights. Drive user engagement in order to create synergy. Generating a holistic approach in order to use best practice. Amplifying below the line to, consequently, come up with a bespoke solution.

Robert Christen

Robert Christen

Momina Aijazuddin

Choose two elective courses (one in the morning and one in the afternoon) running from Monday to Thursday. On Friday, you’ll dive into the other topic during an intensive 2.5-hour seminar, ensuring a rich and varied experience during your stay.

Click on the course to see its full description

MORNING

AFTERNOON

Don’t miss this opportunity!

The tuition fee is € 3,100 euros.

Contact us quickly to start your registration process, especially if you need a visa to attend our programs in Italy.

Spots are limited and will be filled on a first-come, first-served basis.